Elevating Mortgage Brokerage with AI: A Success Story

In a rapidly evolving financial landscape, mortgage brokers find themselves at the epicenter of a sea of change, driven by advances in Artificial Intelligence (AI) and their potential to increase efficiency and personalisation within the industry. But how does one navigate these new currents and truly elevate their mortgage brokerage?

We’ll unravel a compelling story of a mortgage broker who harnessed the power of AI to transform challenges into opportunities, and the remarkable results that followed. If you’re a mortgage broker looking to stay ahead of the technological curve, you’re in for an insightful read.

Meet Dan, Our Protagonist

Dan, a seasoned mortgage broker, was at a crossroads. His business was thriving, partly due to a robust digital marketing strategy that consistently funneled leads his way. Yet, this influx of information also came with a hefty price – an administrative burden that consumed a significant chunk of his time.

Most of Dan’s day was spent sifting through a mountain of paperwork, verifying customer data manually, and addressing repetitive client inquiries. His business was growing, yes, but it was growing pains at their finest. Personalised advisory, the crux of Dan’s consultancy, was taking a back seat to manage the burgeoning demands of his operation.

The Challenge

Streamlining Operations

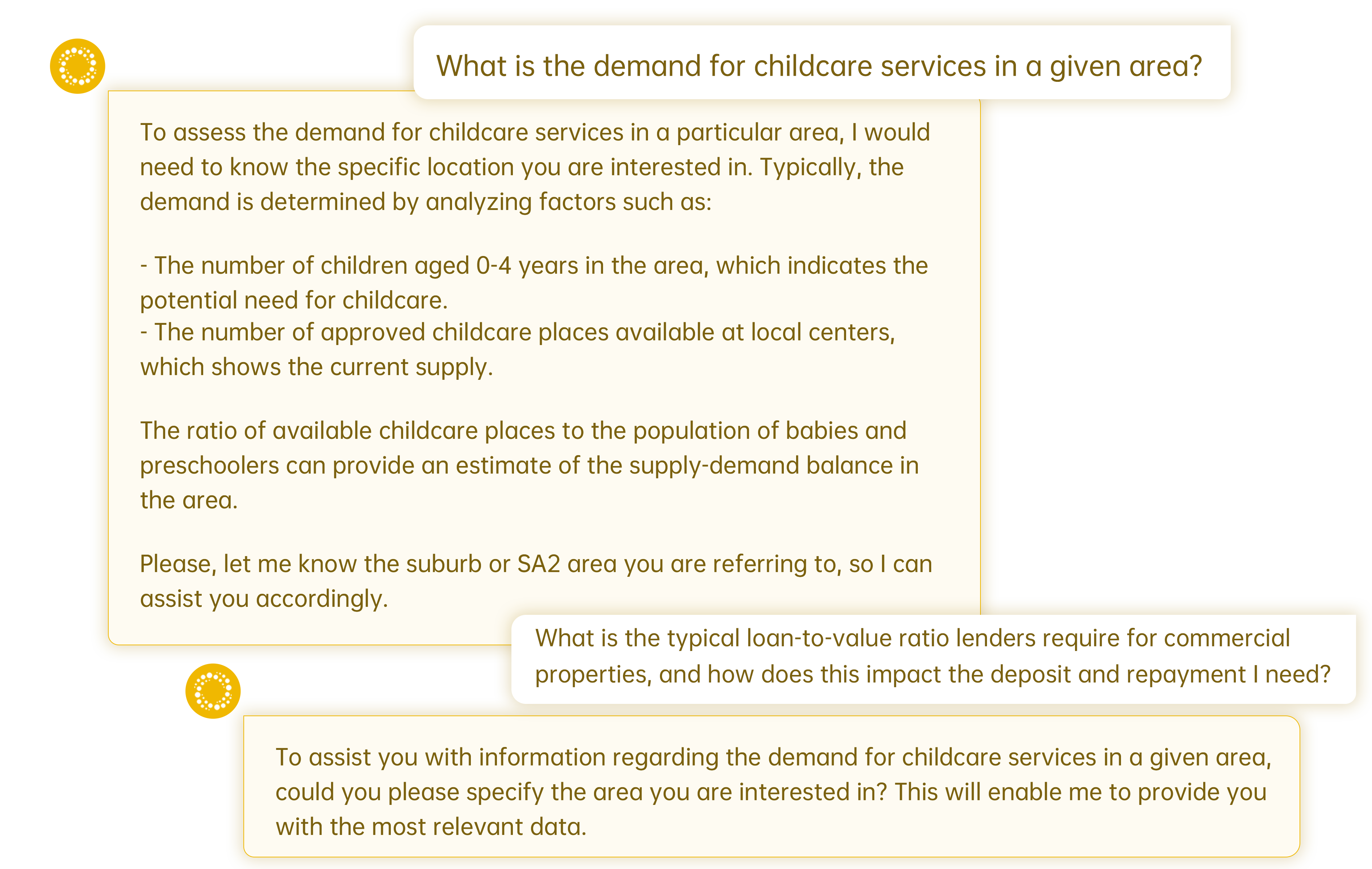

Managing a large volume of digital marketing leads was Dan’s new norm, but it didn’t come without setbacks. Incomplete applications and inaccurate client information plagued his process, leading to a labyrinth of issues that needed untangling.

The first challenge Dan faced was the accuracy and completion of client applications. Even with the advanced lead management software, there was a noticeable spike in incomplete and inaccurate applications. The software didn’t understand the context of mortgage terminology and Nuances. Next, Dan’s client engagement strategies needed optimisation. The generic emails and automation tools didn’t provide the personal touch Dan’s clients needed in such a critical financial decision process.

Dan realised, it was time to pivot. He needed a solution that not only streamlined client engagement but also validated and organised data seamlessly.

The Solution

AI Chatbot to the Rescue

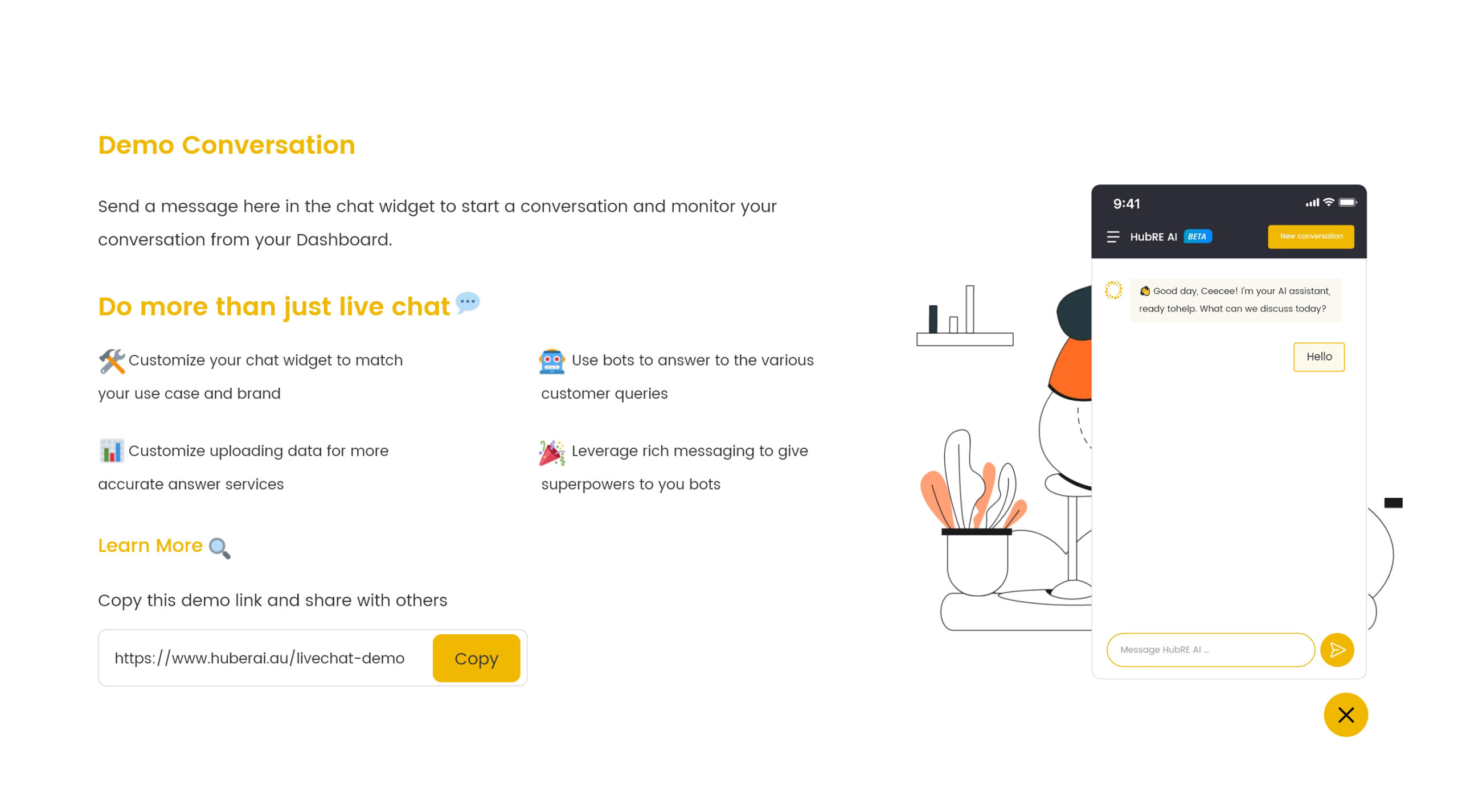

After exploring several AI solutions, Dan stumbled upon HubRE’s AI-powered chatbot, a customised tool designed specifically for mortgage brokerage. The chatbot excelled at handling a varied spectrum of tasks, from managing client queries and pre-qualifying applications to ensuring document integrity and scheduling appointments.

Dan’s first encounter with the AI chatbot was revelatory. It integrated seamlessly into his existing workflow, learning on the go and becoming more adept at handling complex client interactions. It was a game-changer. With HubRE’s AI, Dan found himself with a tireless virtual assistant that was always on, ensuring the back-end of his business ran smoother than ever.

The Outcome

A Confluence of Efficiency and Personalisation

The implementation of AI in Dan’s brokerage led to a remarkable transformation. The chatbot had substantially reduced the workload on Dan’s administrative tasks, freeing him to focus on the aspect of his business that he loved – personal client consultations.

With the chatbot’s ability to operate round-the-clock, client issues and documentation were resolved and verified in real-time, leading to a streamlined handling of applications. The increase in efficiency meant Dan could now cater to a larger client base without compromising on quality. Each client felt like they had his undivided attention, guiding them through their mortgage process with a personalized touch that only a seasoned broker could provide.

How to optimize your charts

Pellentesque lectus cum neque cursus sapien...

personal client consultations.

Pellentesque lectus cum neque cursus sapien...

Lessons in AI Integration

Dan’s story teaches us valuable lessons about AI integration in the mortgage brokerage industry. It underscores the importance of leveraging AI not as a replacement for human touch, but as a tool to enhance the abilities of brokers like Dan.

The success story also highlights the importance of personalised client engagement in the digital age. Automation, when done right, can result in a significant improvement in operational efficiency, allowing brokers to dedicate more time to building invaluable client relationships.

Final Thoughts

AI is no longer the future; it’s the present. Mortgage brokers need to adapt to the changing landscape, harnessing technology to their advantage. By automating tedious tasks and optimising client interactions, brokers can elevate their services to new heights.

Dan’s story reminds us that with the right AI tools, mortgage brokers can not only survive but thrive, providing unparalleled service that resonates with clients and fosters long-term loyalty. Whether you’re just starting in the mortgage industry or a seasoned veteran, Dan’s story serves as an inspiration to incorporate AI into your business, unlocking doors to efficiency and, most importantly, a better client experience.